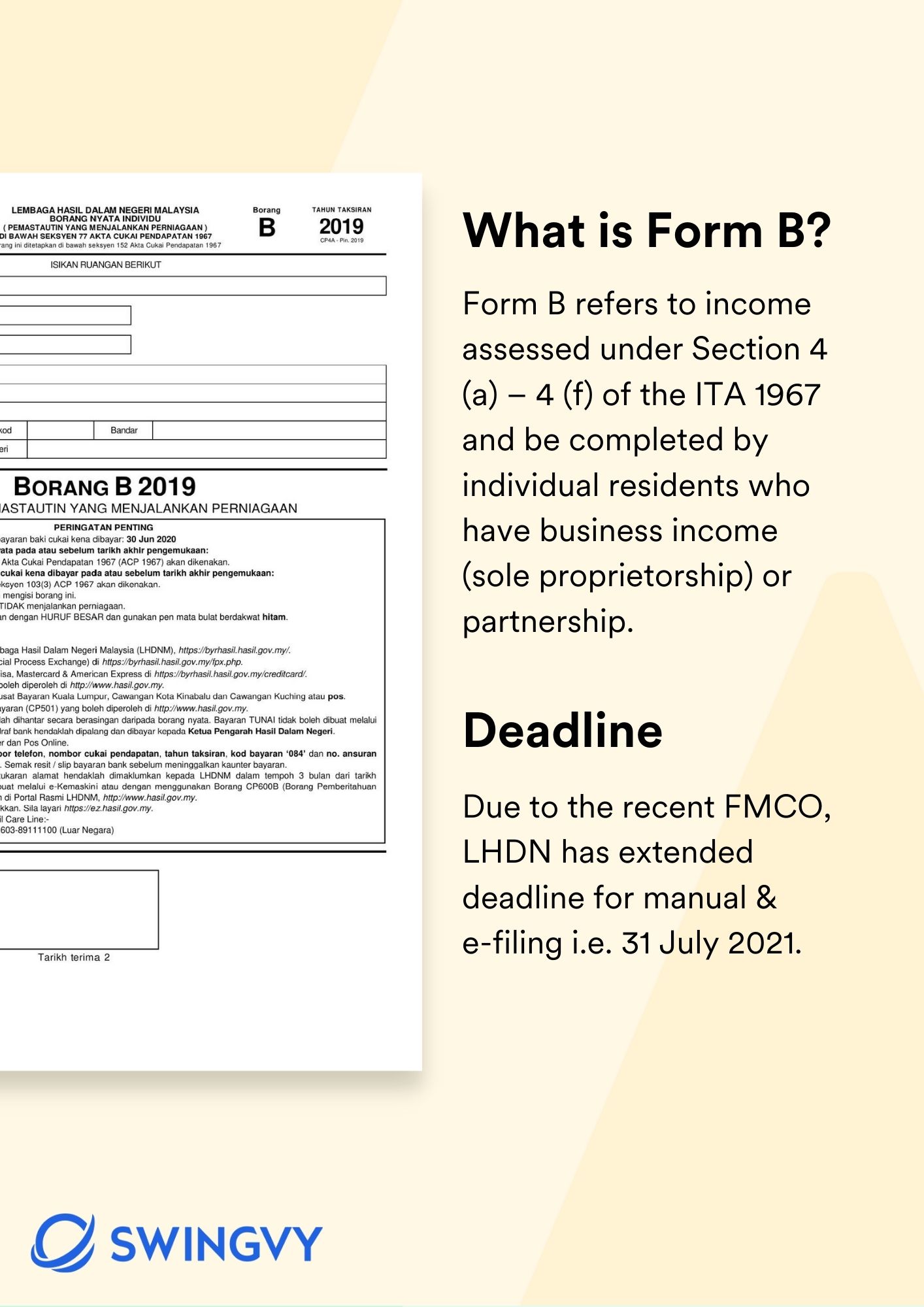

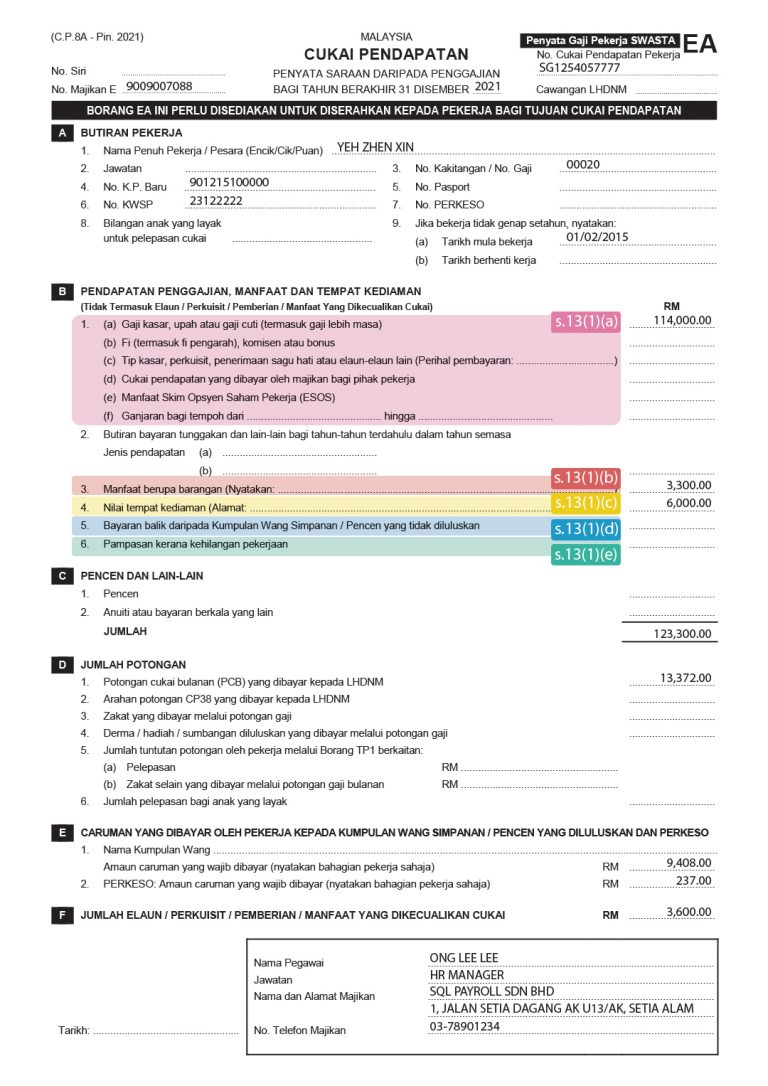

FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

What Is Form E Ea And Cp8d Employers Annual Tax Obligation Otosection

EA Form in Excel Download.

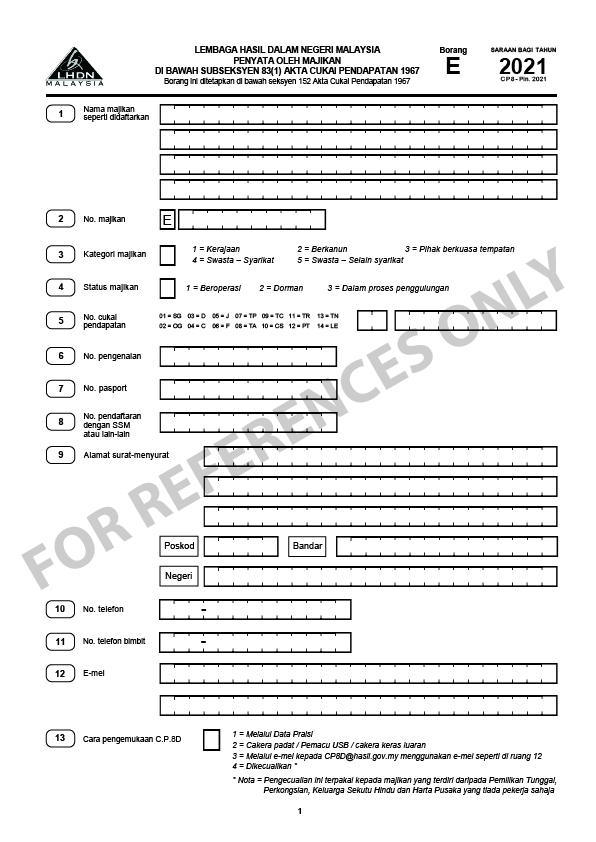

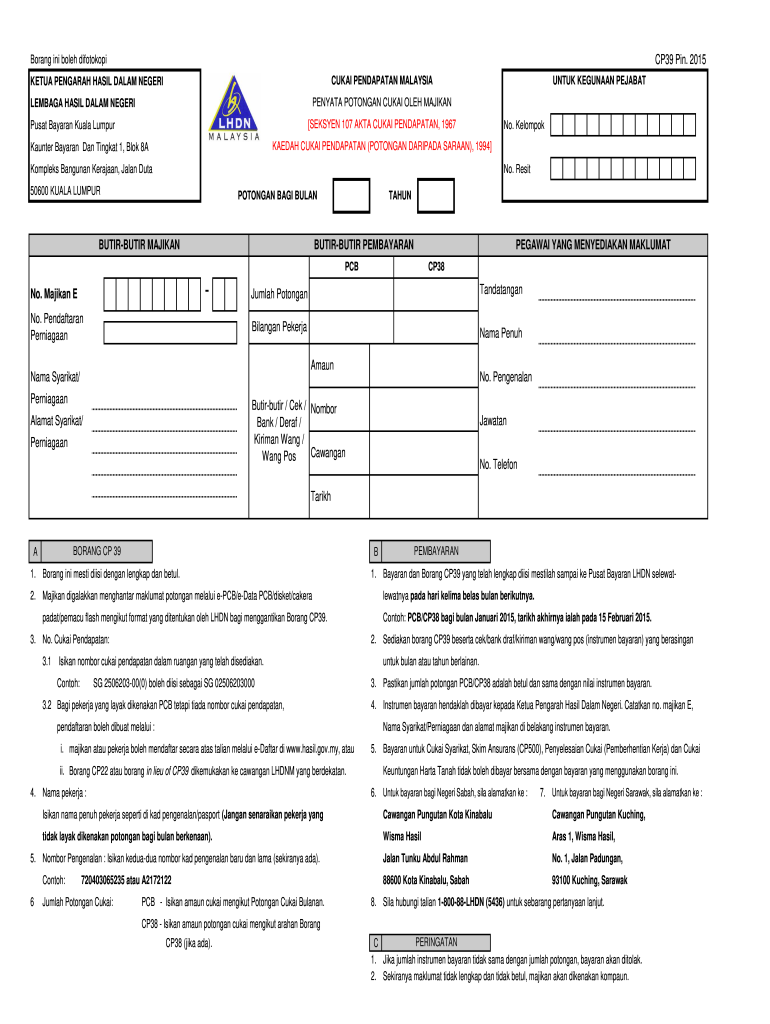

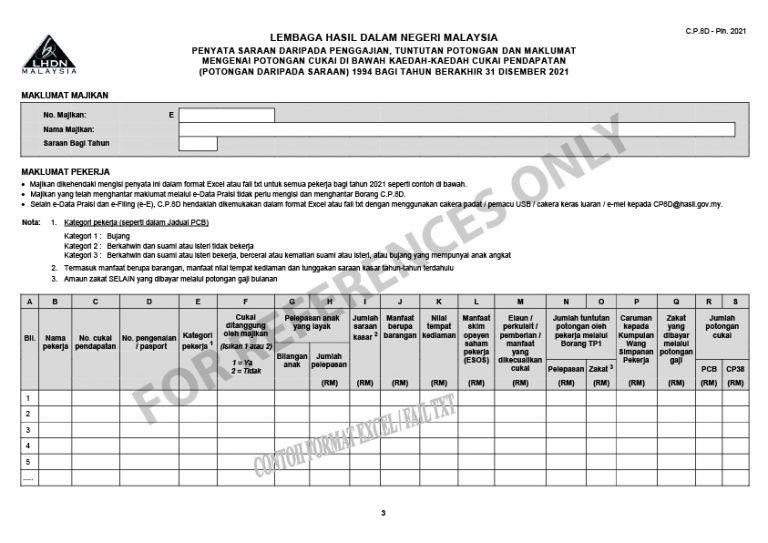

. Borang E contains information like the company particulars and details of every employees earnings in the company. Gunakan satu 1 CD pemacu USB cakera keras luaran untuk satu 1 nombor E. One Borang E-ready software you can consider from the list is Talenox.

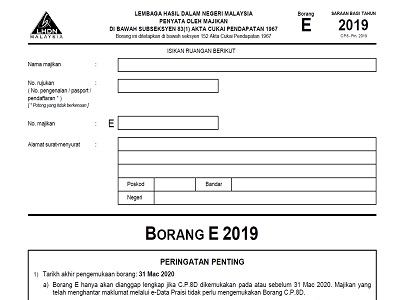

BORANG E 2019 Nama majikan. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the.

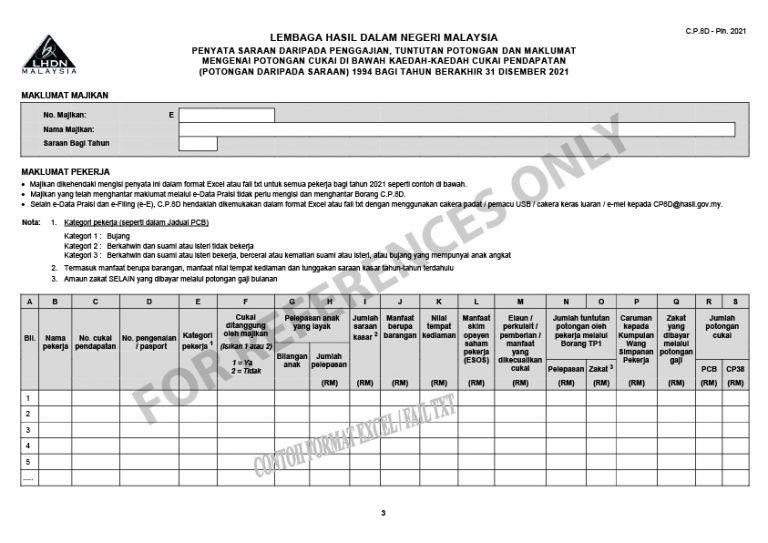

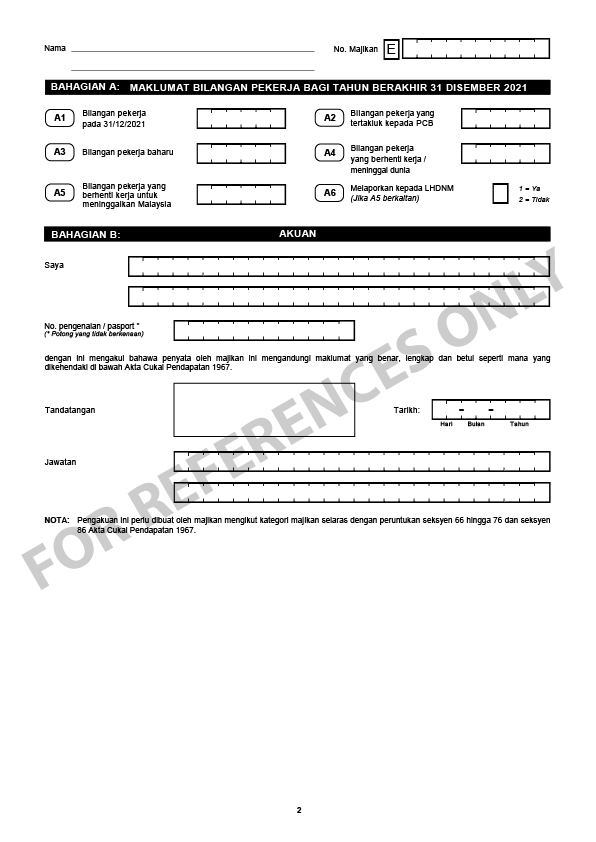

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A.

EA Form Borang CP8A. With Talenox Payroll you can submit Borang E in just 3 steps. KWSP 6 Borang B.

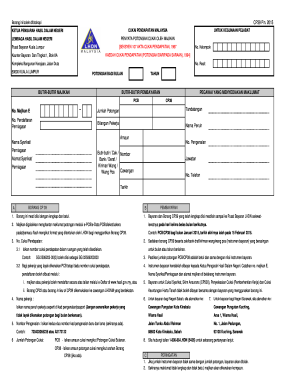

Lembaga Hasil Dalam Negeri Malaysia Special Industry Branch Tingkat 11-13 Blok 8 Kompleks Bangunan Kerajaan Jalan Tuanku Abdul Halim 50600 Kuala Lumpur. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. What is Borang E Form E.

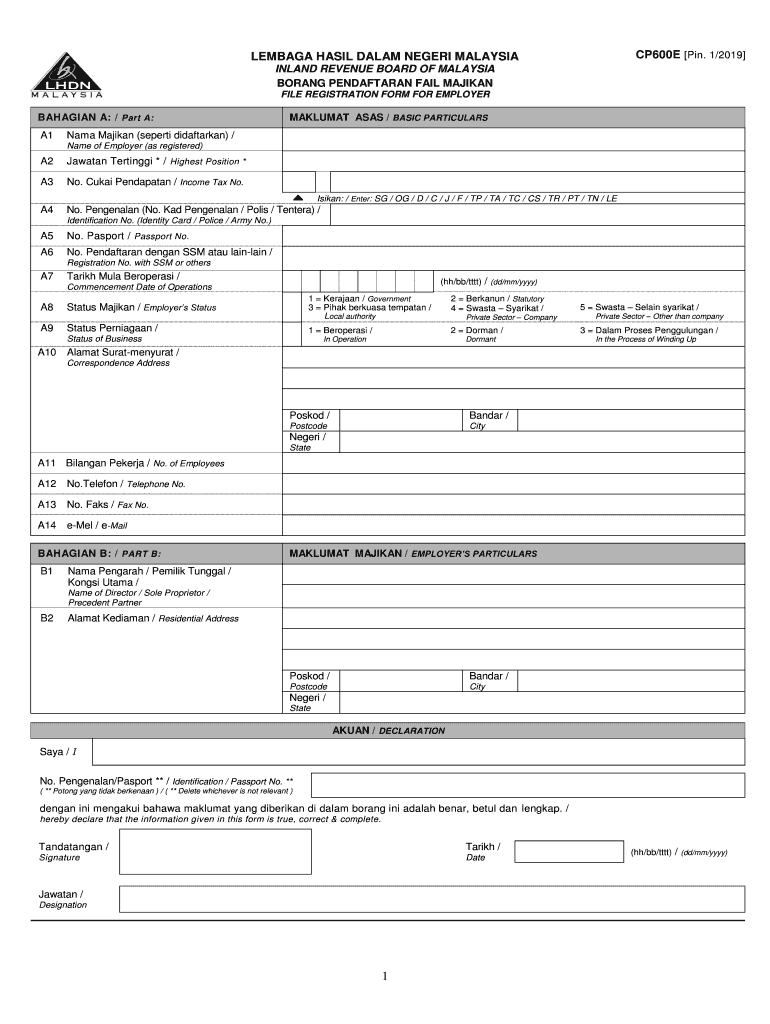

E 2019 Explanatory notes Return Form of Employer Remuneration For The Year 2019 - 1 - BASIC INFORMATION 1 NAME OF EMPLOYER AS REGISTERED Name of employer as registered with the Companies Commission of Malaysia SSM or others. Majikan digalakkan mengemukakan CP8D secara e-Filing sekiranya Borang E dikemukakan melalui e-Filing. Socso borang 8a excel file.

EA Form in PDF Download. Enter your official identification and contact details. Head over to Payroll Payroll Settings Form.

Form E is an employee income declaration report that employers have to submit every year. Pengemukaan CP8D melalui disket TIDAK dibenarkan. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

If there is any change to the employers name please indicate the former name in parenthesis. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara. 03-89111000 603-89111100 Luar Negara TAHUN TAKSIRAN 2019 CP2D - Pin.

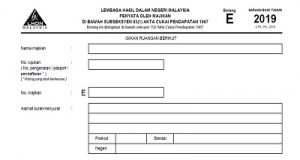

2019 Borang SARAAN BAG I TAHUN E LEMBAGA HASIL DALAM NEGERI MALAYSIA PENYATA OLEH MAJIKAN CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah. Form CP251 NEW FORMS CP250 CP 251 WILL TAKE EFFECT FROM JUNE 2018.

Borang Pendaftaran Kelas Revisi 2019. The Borang E must be submitted by the 31st of march of every year. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019.

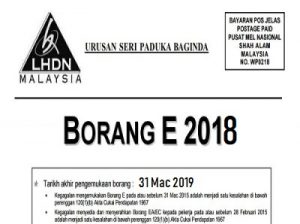

To get started on the document utilize the Fill camp. KWSP 8 Borang F. 1 Tarikh akhir pengemukaan borang.

159348 Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Headquarters of Inland Revenue Board Of Malaysia.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. 2E 3Status of employer. How to complete the Boring e filing then form online.

Jabatan Kewangan Jabatan Undang Undang Dan Pendakwaan Jabatan Pelesenan Dan Pembangunan Perniagaan Jabatan Pengurusan Sumber Manusia Jabatan Perancangan Bandaraya Jabatan Penilaian Dan Pengurusan Harta Jabatan Kejuruteraan Awam dan Saliran Jabatan Pengangkutan Bandar. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Schedule of Contributions.

English Version CP8D CP8D-Pin2021 Format. Available in Malay Language only. Utilize a check mark to indicate the.

31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Pengenalan pasport pendaftaran Potong yang tidak berkenaan. The advanced tools of the editor will guide you through the editable PDF template.

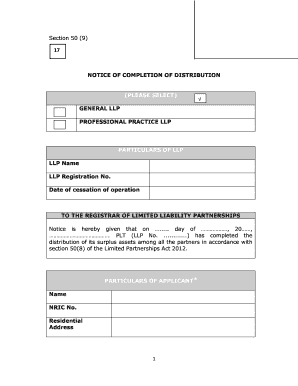

In addition every employer shall for each calendar year prepare and render to. Notice of Cessation of Liability as an employer. Talenox is a self-service HR SaaS that helps thousands of companies avoid penalisations and audits by accurately auto-calculating their salaries and taxes for free.

1 Tarikh akhir pengemukaan borang. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. This form is prescribed under section 152 of the Income Tax Act 1967 Date received 1 Date received 2 FOR OFFICE USE E RETURN FORM OF EMPLOYER 4 Private 4 Identification 1 2019 CP8-Pin.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Sign Online button or tick the preview image of the form.

Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar CP8D. E 2021 Explanatory Notes and EA EC Guide Notes. Socso table socso form socso number socso klang socso 2016 socso borang 8a socso online socso claim.

Section 83 1A Income Tax Act 1967. Poskod Bandar UT 019 CP8 - Pin. Borang E 2021 PDF Reference Only.

The following information are required to fill up the Borang E. KWSP 7 Borang E. 2019 Form FOR THE YEAR REMUNERATION 1 Name of employer as registered E Employers no.

Employers companys particular Details for ALL employees remuneration matters to be included in the CP8D. This form can be downloaded and submitted to.

Index Of Blog Wp Content Uploads 2019 03

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Cp39 Login Fill Out And Sign Printable Pdf Template Signnow

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

Pcb2 Fill Online Printable Fillable Blank Pdffiller

Fillable Online E Credit Form Borang E Kredit Prubsn Com My Fax Email Print Pdffiller

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

Swingvy On Twitter Employers Take Note Lhdn Has Extended Deadline For Form B Form P Manual And E Filing Which Is Due On 31 July 2021 Instead Of 15 July 2021

Payroll Borang E Form 2 Otosection

Get And Sign Borang 9 Ssm Form

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

2015 2022 Form My Cp39 Fill Online Printable Fillable Blank Pdffiller

Borang E Archives Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory